It is natural to assume that being a millionaire is wonderful and that there are no longer problems or issues with life. While you will not find much sympathy for millionaires, there is a need for people who have this sort of money to take proper care of their finances. Just because a person has a lot of money doesn’t mean they should be wasteful with the management of their wealth and you’ll find that one of the secrets to becoming a millionaire will revolve around the proper management and utilization of income and money.

image source: here

With this in mind, you’ll find that having rules or guidelines in place will help you achieve your financial aims. If the rules and guidelines work for you, you can keep following them, but if they aren’t protecting your money, you have a platform to make changes that will hopefully help you to make better decisions in the long run.

Have various income streams or investment plans

When it comes to managing money, taking the risk out of your finances and building towards a stronger financial future, it makes sense to diversify how you make money or how you invest your money. You’ll find that millionaires, even ones who made their dollars in a singular manner or industry, will create a portfolio where they utilize their money to best effect.

That may bring about a smaller return than by committing entirely to something that turns out to be successful but equally, if a sizable investment were made on something that failed, the losses would be considerable. Managing and using money when you are a millionaire is often about pragmatism so it makes sense to spread your investments.

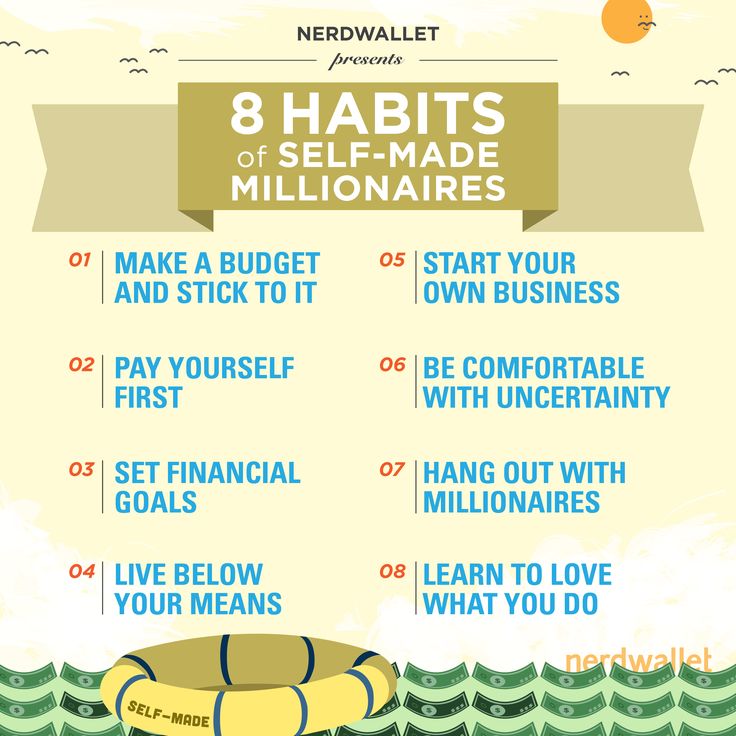

Create a budget

If you were a millionaire, you might think you would have complete financial freedom and that you didn’t have to worry about any bills. While a millionaire may be confident of having enough money in his or her bank account to ensure their card won’t be declined when buying groceries, you’ll find that most millionaires who are intent on remaining millionaires know their budget.

Live within your means

This is good advice for everyone, regardless of how much money you have, and it is perhaps useful to know that being a millionaire shouldn’t change how you view and use your money. You should know your budget, what money you have available and then live within these means. If you do this, you will remain well off, but if you outlive your means, your money will diminish and eventually, you may find yourself in a challenging financial position again.

Understand what you invest in

As a millionaire, you should have more time to study or learn new things. That is good but if you are investing, make sure you invest in markets or products you understand or have a passion in. An informed decision is usually always better than a guess or deciding on a whim.

Get smart financial advice

It is, of course, one thing to become a millionaire after years of hard work and determination with a plan or structure in place. That can be a challenge but people who find themselves becoming a millionaire in an instant, with a lottery winner being the prime example, find themselves in a life-changing situation. Therefore, there is a need for such winners to receive as much support as possible, both in respect of managing their money and in dealing with the psychological impact of having this amount of cash suddenly available.

Getting the right sort of advice in life is essential, and that is why the best standard of financial advice for lottery winners is crucial. Many people daydream about having access to the funds associated with a lottery win, but there is a need to understand the pressures of this money and some of the problems it can bring. Being a lottery winner is a life-changing experience and with the right guidance and support, it can be a wholly positive one.

You may think being a millionaire is an unlikely ambition, but it is worth considering how millionaires made their money and how they protect their finances. Following the guidance of millionaires on how they control their investments, income and expenditure can help you improve your financial outlook.