One huge challenge when trying to purchase your own house is financing the down payment. To avoid struggling with this issue, here are some wise tips that you should pick up:

-

Make sure you have a good credit score.

Take note that credit will have a lot to do with getting a loan, whatever type it is. So, make sure that you have a good score to receive more options and even enjoy a lower amount of down payment.

-

Get your savings automated.

Financial experts recommend that you should set aside a good portion of your paycheck to be automatically deposited into an account that is specifically reserved for buying your house. Remember that this savings account can also be used for closing, moving and buying items for your new place.

-

Compare your savings to your down payment.

This is very important when investing in real estate. You can use various resources on the internet where you can save money from matching the amount that you will save from the home purchase to the down payment that you are about to make. So, take time to check on these websites.

-

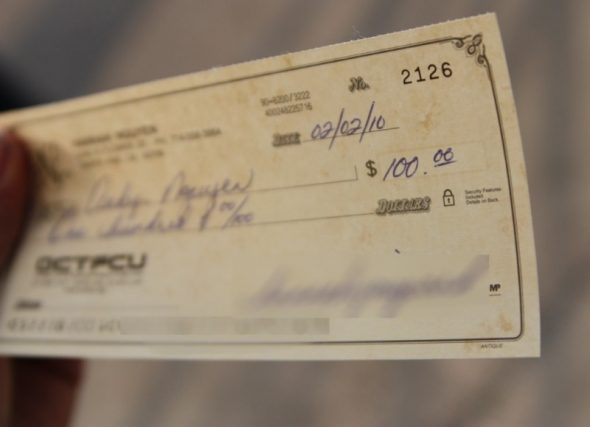

Take advantage of gift money.

If you are a first-time homebuyer, it is most likely that you will seek help from your family to produce down payment for your new home. While this is a good solution, there are things that you should look into, such as the percentage of a mortgage that would be regarded as gift, though this would also depend on the lender. Remember that gift money should come from an immediate family member, so you need to present documentation to your lender to prove it. If you do plan to use such money, make sure to talk with your lender beforehand just to make sure you receive all the details.

By considering these tips, you will be off a good start in funding down payment in your real estate investment.